This expert is available free of charge to members. To use the expert you will have to enter a product registration code. Registration codes are available for your linked trading accounts.

Click here to obtain your registration code

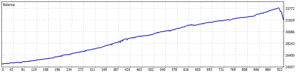

The Charon EA aims to profit from ranging markets by placing buy and sell orders at predefined intervals (the grid). It uses a trailing stop loss to lock in profits and a trailing entry to catch directional price movements. The EA can also implement Martingale money management, increasing trade size as the grid size increases. It can be configured with time and spread restrictions to avoid trading during specific periods.

This expert advisor is not suitable for use with netting or FIFO accounts.

Automated trading involves risk. Past performance is not indicative of future results. The author(s) and distributor(s) of the Expert Advisor and other materials are not responsible for any losses incurred.

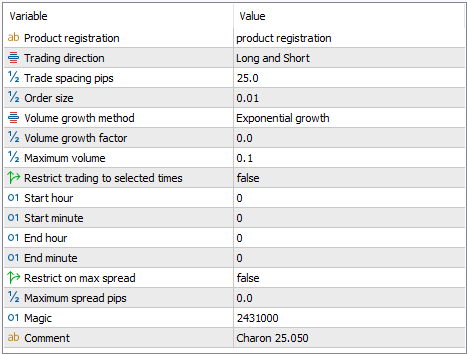

| Product Registration | To use this on a live account you will need a product registration code. Registration codes are available for subscribers. See the guide for more information. |

| Trading Direction | Set to both or select to allow new trades in one direction only |

| Trade Spacing pips | Minimum distance between trades in the same direction |

| Order Size | The size of the first trade placed in a grid in each direction |

| Volume Growth Method, factor, max volume | Use these for martingale if required. Growth = none will not use martingale. See the guide for more information |

| Restrict trading to selected times | To avoid known periods of market instability |

| Restrict spread | To avoid entering new trades when spread is too wide |

| Magic | To uniquely identify trades placed by this expert |

| Comment | Added to each trade. |

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Automated trading involves risk. Past performance is not indicative of future results. The author(s) and distributor(s) of the Expert Advisor and other materials are not responsible for any losses incurred.

This expert advisor is not suitable for use with netting or FIFO accounts.

Sponsored products require a registration code. Registration codes are issued for qualified accounts.

When you sign up to a broker using our registration links any accounts you create with that broker will be qualified accounts. We assign registration for those accounts usually within 24 hours of the account being funded.

To get the registration code for the account go to

And enter your Metatrader account number.

For use on a demonstration account you can enter a registration code if you have one for that account (we don’t normally issue registration codes for demonstration accounts) or you can operate without registration.

There is no restriction on use in the strategy tester.

This guide explains how to use the “Charon” Expert Advisor (EA) for MetaTrader 5.

This EA uses a grid trading strategy with trailing entry and trailing stop features. It automatically opens trades based on price movements relative to a defined grid size and optionally manages these trades using martingale principles and time-based restrictions.

The Charon EA aims to profit from ranging markets by placing buy and sell orders at predefined intervals (the grid). It uses a trailing stop loss to lock in profits and a trailing entry to catch directional price movements. The EA can also implement Martingale money management, increasing trade size as the grid size increases. It can be configured with time and spread restrictions to avoid trading during specific periods.

See the general installation guide at

Or use the link to installation instructions that would have been included with the download zip file.

After attaching the EA to a chart, a window will appear with a list of input parameters. These settings control the EA’s behavior. Here’s a breakdown of the key parameters:

You will need to obtain a registration code for your metatrader account to use this expert on a live account. See the information at the top of this guide.

This allows you to specify that trades are taken in one direction only. It can be useful in markets where there is a general trend bias in one direction. This will only affect opening new trades. Options are:

Set the minimum distance between trades in the same direction. Due to slippage some trades may enter the market closer than this and the algorithms to detect price movement may take trades further apart.

Sets the lot size for the first order. The first order or trade is the trade placed when there are no other open trades in that direction.

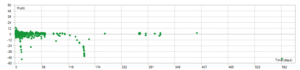

Martingale is optional and should be treated with caution. In the right circumstances it can lead to increased profits but if market conditions are not suitable it can lead to very heavy losses and even loss of your entire account. It is not recommended but is provided here to use at your discretion.

Values are:

For all growth calculations lot size is rounded down to the nearest applicable lot size for the current trading instrument.

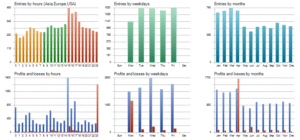

Use these restrictions to avoid entering trades in unfavourable conditions. The restrictions affect opening new trades but do not affect closing or modifying existing trades.

Set “Restrict trading to selected times” to true and then set the start hour and minute and the end hour and minute. The input separates hours and minutes to make it easier for you to run optimisations where these values are adjusted. If you set the times to be the same then no restrictions apply. If the end time is before the start time then it is assumed that the time spans midnight.

Set “Restrict on max spread” to true and enter a maximum spread in pips. If the current spread is greater than the spread specified then no trade is placed. This most often happens at the start and end of the day but can happen any time depending on market conditions.

All trades created by an expert advisor can have a magic number applied. This allows the expert to identify trades being managed by the expert in case there are other experts running on the same account.

Trades can be identified as being placed by the expert advisor by a combination of Symbol and Magic Number. If you run another expert on the same symbol, or run the same expert with different settings, make sure that the magic numbers are unique.

A comment that will be added to the EA’s trades.

Risk Management: Be cautious with the Martingale settings. A high multiplier can lead to rapid account depletion if the market moves against you. Start with a low multiplier and monitor the EA’s performance closely.

Grid Size: The appropriate grid size depends on the volatility of the currency pair and your trading style.

Always backtest the EA on historical data to evaluate its performance and optimize the input parameters for your desired trading style and market conditions.

Carefully consider your risk tolerance and use appropriate stop-loss levels. Do not risk more than you can afford to lose.

The EA’s performance may vary depending on market conditions (e.g., trending vs. ranging markets).

Ensure that the EA is compatible with your broker’s platform and trading conditions.

For continuous operation, the EA should be run on a Virtual Private Server (VPS).

Regularly monitor the EA’s performance and make adjustments as needed.