This expert is available free of charge to members. To use the expert you will have to enter a product registration code. Registration codes are available for your linked trading accounts.

Click here to obtain your registration code

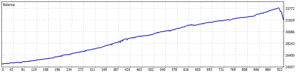

Triton B is a mean reversion Expert Advisor designed for traders looking to capitalize on market movements toward equilibrium. The EA dynamically enters trades when price action touches the outer limits of a predefined band, anticipating a return to the mean.

Multi-Trade Capability: If the entry trigger is met before an existing trade closes, the EA can initiate additional positions, ensuring full exposure to reversal opportunities.

Smart Averaging Mechanism: When multiple trades are active, Triton B applies an averaging method to optimize closing conditions, allowing all trades to be exited at a calculated average price point.

This expert advisor is not suitable for use with netting or FIFO accounts.

Automated trading involves risk. Past performance is not indicative of future results. The author(s) and distributor(s) of the Expert Advisor and other materials are not responsible for any losses incurred.

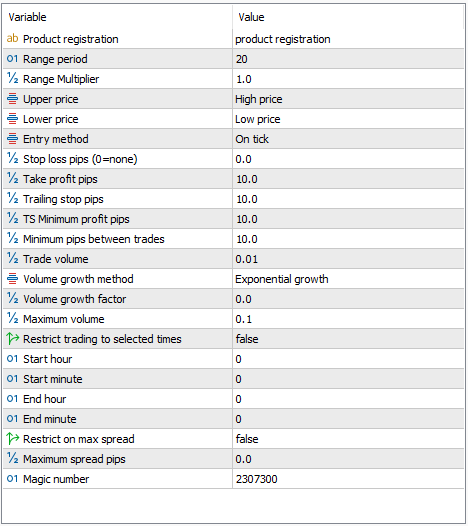

| Product Registration | To use this on a live account you will need a product registration code. Registration codes are available for subscribers. See the guide for more information. |

| Range Period | The period is in number of bars (according to the current chart timeframe) and determines the period used to identify range low and high. |

| Range Multiplier | This is used to multiply the standard range width used to set the upper and lower boundaries where trading will occur. |

| Upper / Lower price | Allows setting a different base price to calculate the upper and lower boundary levels |

| Entry Method | On Tick On Bar Close On Confirmation bar close |

| Stop loss pips | Stop loss for the initial trade, 0 = no stop loss |

| Take profit pips | Take profit pips for the initial trade. 0 = no take profit |

| Trailing stop pips | Distance behind best price to trail, 0 = no trailing stop |

| TS Minimum profit pips | Trailing stop will not be applied until the trailing stop is at least this far ahead of the entry price |

| Minimum pips between trades | Distance behind the tail trade before opening a new trade. |

| Trade Volume | Lot size for the first trade |

| Volume Growth method | Method to apply the growth factor. See the guide for more information. No Growth Exponential Linear |

| Volume growth factor | Amount to increase the volume for averaging trades. See the guide for explanations based on growth method |

| Maximum Volume | Limits maximum volume per trade |

| Restrict trading to selected times | Select true to restrict trading and set the start and end hour and minute. |

| Restrict on max spread | Set true to avoid taking trades when the spread is greater than the specified maximum. |

| Magic Number | Magic number applied to each trade |

Automated trading involves risk. Past performance is not indicative of future results. The author(s) and distributor(s) of the Expert Advisor and other materials are not responsible for any losses incurred.

This expert advisor is not suitable for use with netting or FIFO accounts.

Sponsored products require a registration code. Registration codes are issued for qualified accounts.

When you sign up to a broker using our registration links any accounts you create with that broker will be qualified accounts. We assign registration for those accounts usually within 24 hours of the account being funded.

To get the registration code for the account go to

And enter your Metatrader account number.

Triton B operates by trading reversion based on Bollinger bands. When price reaches the upper band the expert will sell and when price reaches the lower band the expert will buy.

There is also an averaging mechanism where, if price continues to move against the trade another trade will be entered and the closing price for the basket of trades is set to an average price.

In the terminology used here the head trade is the first trade placed for a given direction. It would be the highest priced buy trade or the lowest priced sell trade. The Tail trade is then the trade furthest away from the head trade.

Averaging trades are not placed at a fixed distance. They are placed when the expert receives another entry signal.

If there is a minimum distance between trades then an average trade will not be placed unless it is at least the specified distance behind the tail trade.

Triton B trades on reversion when the price reaches the outer limits of Bollinger bands. The range period is used to define the period for the Bollinger Bands and multiplier is used to set the number of standard deviations away from the mean to set the outer band levels.

Upper and Lower price settings allow you to use a different base price to calculate the Bollinger bands that will be used for the upper range and lower range limits

Trading occurs as soon as the price reaches the range boundary

Trading occurs when the candle closes outside the range boundary

Trading occurs when a candle has opened outside the range boundary and then closes inside the range boundary

The trailing stop is applied to each trade individually. That is, if there is an initial trade and a number of averaging trades open the trailing stop will apply to each trade where the current price is ahead of the trade.

There is an option to increase the size of averaging trades. This allows faster recovery but also increases the holding size in cases of a significant price movement and the risk involved. Use this cautiously.

Set the volume growth factor to zero and there will be no volume growth. All averaging trades will be placed at the same size as the initial trade (as set in the inputs).

The volume growth method has several options. All are subject to rounding down to the nearest appropriate lot size for the instrument being traded.

Growth is limited by the setting in Maximum volume. This is the maximum volume that can be applied to each new trade.

The volume for an average trade is increased exponentially based on number of trades open (in the same direction), initial trade volume and the growth factor.

(initial volume) * (1 + growth factor)(number of open trades)

The volume is increased by a linear multiple of the growth factor

(initial volume) + (growth factor * number of open trades)

All trades created by an expert advisor can have a magic number applied. This allows the expert to identify trades being managed by the expert in case there are other experts running on the same account.

Trades can be identified as being placed by the expert advisor by a combination of Symbol and Magic Number. If you run another expert on the same symbol, or run the same expert with different settings, make sure that the magic numbers are unique.

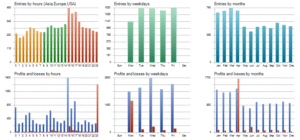

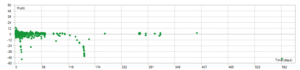

Always backtest the EA on historical data to evaluate its performance and optimize the input parameters for your desired trading style and market conditions.

Carefully consider your risk tolerance and use appropriate stop-loss levels. Do not risk more than you can afford to lose.

The EA’s performance may vary depending on market conditions (e.g., trending vs. ranging markets).

Ensure that the EA is compatible with your broker’s platform and trading conditions.

For continuous operation, the EA should be run on a Virtual Private Server (VPS).

Regularly monitor the EA’s performance and make adjustments as needed.